Can you really trust a lesser-known insurer with your car? With so many new options popping up, it’s easy to feel unsure. Safex Insurance promises affordable auto coverage but is it truly reliable when you need it most? In this honest review, we’ll explore real Safex Insurance customer experiences, claims handling, and overall service quality. If you’re considering Safex for your car insurance needs, this guide will give you the key facts you need to make a confident decision.

Key Takeaways

- Safex Insurance is not a direct insurer; instead, it functions as a lead generation service that connects you with third-party insurance companies. This means the quotes you get may not come from Safex itself.

- While Safex advertises low rates of $39 to $50 per month, these offers are not guaranteed. Once you enter the system, you may receive offers from multiple insurers, and the price could be higher than what was originally advertised.

- If you prefer a more straightforward and transparent process, it might be a good idea to explore alternative insurance providers. Many trusted insurers offer clear quotes and coverage without the need for marketing funnels or unnecessary calls.

Table of Contents

What is Safex Insurance?

Safex Insurance promises affordable car insurance coverage, with rates advertised as low as $39 per month. However, the reality behind these offers is not as straightforward as it might seem. Instead of providing car insurance directly, Safex operates as a lead generation service. This means Safex collects your personal information and then connects you with third-party insurance providers, who may offer you policies based on the details you’ve shared.

Safex: A Lead Generation Service, Not an Insurance Provider

It’s important to understand that Safex is not an insurance company itself. Rather than directly offering insurance, Safex acts as an intermediary that collects data from users and passes it on to a network of insurance companies. This means that the rates you see advertised such as the $39 to $50 per month coverage are not necessarily guaranteed by Safex. Instead, they serve as an initial hook to get you into their system.

When you sign up, you provide your personal details, including your phone number. By doing so, you agree to be contacted by various insurance agents from Safex’s marketing partners. This often leads to multiple calls from different insurers, pitching you different offers. The downside? You’re not dealing with a single insurance company that offers you a clear, transparent quote. Instead, you’re entering a marketing funnel where your information is passed around, and different insurers compete for your business.

In short, Safex offers a way to compare insurance quotes, but it does not directly provide insurance itself. This can sometimes lead to confusion and frustration, especially when you find yourself dealing with multiple offers and unexpected higher prices. If you’re looking for a simple and direct way to buy car insurance, Safex might not be the best choice for you.

How Safex Insurance Works: The Process Explained

Safex Insurance presents itself as a convenient solution for securing car insurance at rates as low as $39 per month. However, it’s important to understand how Safex actually operates. Contrary to what the ads might suggest, Safex does not directly offer insurance coverage. Instead, it functions as a lead generation service that connects you with insurance companies based on the information you provide.

Steps to Sign Up for Safex Auto Insurance

Signing up for Safex auto insurance is straightforward and simple, but it’s important to know what you’re getting into. Here’s a breakdown of the process:

Provide Personal Information: You’ll need to enter basic details, including your car’s information, current insurance policy details, date of birth, marital status, and driving history.

Enter Your Phone Number: This is where things start to get tricky. By submitting your phone number, you’re agreeing to be contacted by insurance agents from various companies.

While it may seem like a quick and easy way to get a cheap insurance quote, the reality is a bit more complicated, as the system primarily works by collecting your data and passing it to insurance companies rather than offering a direct insurance plan.

The Marketing Partner Network and How It Affects You

Once Safex gathers your information, it’s passed on to their network of marketing partners. These are third-party insurance providers that will then reach out to you with offers. While this might seem like a chance to get multiple quotes, the downside is that it opens the door to being bombarded with calls and messages from several insurers.

In this process, the initial low-cost offers (like $39 to $50 per month) you see in Safex’s ads are not guaranteed. Rather, these offers are used to get you into their system, where insurers will then compete for your business.

This marketing funnel means you’re not getting a simple, direct quote. Instead, you’ll likely have to navigate a series of calls and offers, which can be overwhelming and confusing. It’s crucial to approach Safex with the understanding that you might not get the deal you initially thought was being offered.

Pros and Cons of Safex Insurance

When considering Safex Insurance, it’s important to weigh both the benefits and drawbacks before making a decision. While it may appear as an attractive option at first glance, there are various factors to consider. Below are the key pros and cons based on the available information.

The Pros of Using Safex Insurance

- Quick Quotes: Safex’s main appeal is the speed at which it provides auto insurance quotes. If you’re in a rush and need to compare rates, Safex allows you to quickly enter basic information and receive potential offers from insurance providers.

- Potential for Good Deals: While Safex doesn’t directly provide insurance, it connects you to multiple insurers who may offer competitive pricing. This could result in discovering a great deal, especially if you’re willing to navigate through different offers.

- Simple Sign-Up Process: The sign-up process is straightforward and doesn’t require too much information upfront. This can be an attractive feature for anyone looking to explore insurance options without jumping through too many hoops.

- Access to Multiple Providers: By submitting your information to Safex, you may be exposed to a wide array of insurance providers, potentially increasing your chances of finding the right coverage for your needs.

The Cons of Using Safex Insurance

- Multiple Calls from Insurance Agents: One of the major downsides of using Safex is the overwhelming amount of marketing calls you’ll likely receive. After submitting your personal information, you agree to be contacted by a network of insurance agents, which can lead to a barrage of phone calls and messages.

- Unclear Pricing: While Safex promises attractive rates (as low as $39 a month), the reality is that these offers aren’t directly from Safex itself. Instead, it’s part of a marketing funnel, meaning you may not get the exact deal you were expecting. This can make pricing feel uncertain and less transparent.

- Lack of Direct Insurance Coverage: Safex does not actually provide insurance itself. It merely collects your data and passes it on to other companies. This can lead to confusion, as you’re not getting a direct quote from a specific insurer but rather entering a marketing system where multiple insurers compete for your business.

- Possible Scams or Unwanted Offers: Some users have reported feeling misled by the $39-a-month offer, as it may not lead to the expected coverage. You may find yourself in situations where the initial offer turns out to be a bait-and-switch, or you could end up receiving offers that don’t match your expectations.

In conclusion, while Safex might seem like an easy way to find cheap auto insurance, the reality is more complex. If you’re comfortable navigating through a marketing network and don’t mind receiving multiple calls from various insurers, Safex might be worth considering. However, if you’re looking for a straightforward, direct insurance provider, it may be worth looking elsewhere.

Safex car Insurance Review – I Tried It So You Don’t Have To

You’ve probably seen those eye-catching ads promising Safex Insurance coverage for as low as $39 a month for a two-year plan. The idea of affordable, long-term car insurance coverage sounds too good to be true, right? Well, I thought the same thing, so I decided to put it to the test.

In the video below, I walk you through my personal experience with Safex Insurance, from getting a quote to evaluating the offer. Is it really as cheap as the ads claim? Or is it just a bait-and-switch tactic to get you caught in a web of endless calls from insurance agents?

Watch the video to find out if Safex’s “too good to be true” offer is legit or just another marketing gimmick.

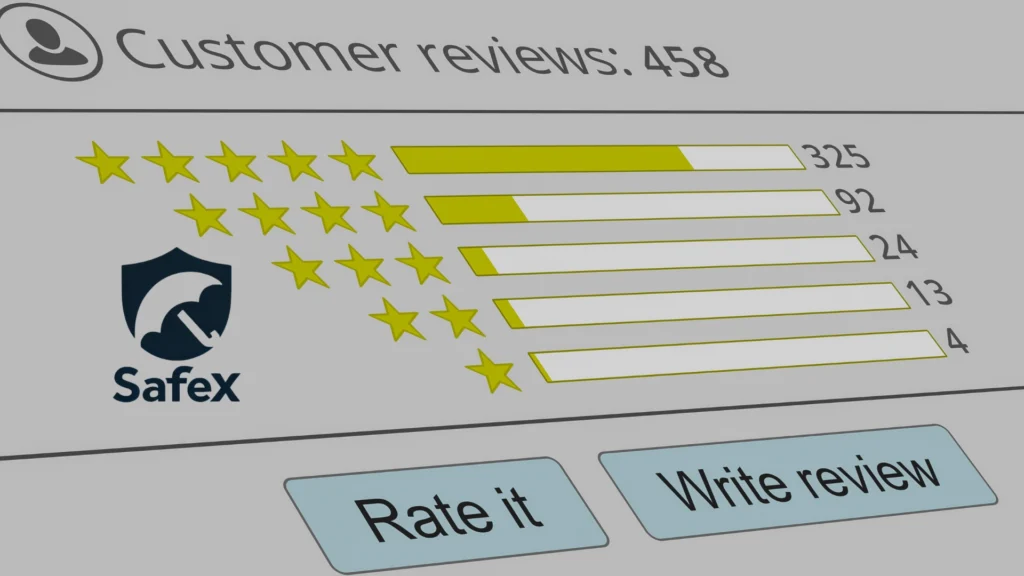

Safex Insurance Reviews: What Are Customers Saying?

Before deciding on Safex Insurance, it’s crucial to consider what actual customers are saying. Real-life experiences can offer valuable insights that help you understand whether Safex truly delivers on its promises. Below, we’ll explore customer feedback from two key sources: Trustpilot and the Better Business Bureau (BBB).

Real Customer Experiences on Trustpilot

Customer reviews on Trustpilot offer a mixed perspective on Safex Insurance. However, many reviews express frustration with the overwhelming number of marketing calls and messages after submitting their information. A common complaint is that Safex isn’t an insurance provider but a lead generation service. This means that users are often bombarded with calls from various agents and insurers instead of getting a clear, straightforward insurance policy.

On the positive side, a few customers mention that they were eventually connected with a reputable insurer offering competitive rates. But these customers caution others to be wary of the marketing gimmicks and keep in mind that Safex is more of a middleman rather than a direct insurance provider.

BBB Ratings and Customer Feedback

The reviews and ratings on the Better Business Bureau (BBB) website present another angle of Safex Insurance. As of now, Safex Insurance has a generally low rating on the BBB, with multiple complaints from customers regarding misleading advertisements and poor customer service. Many customers have reported dissatisfaction with the initial offers they received through Safex, highlighting the discrepancy between what was promised in ads and the reality of the insurance options they were presented with.

One of the most common complaints involves the confusion surrounding Safex’s role in the insurance process. As a lead generation service, Safex collects customer data and passes it along to other insurers. Unfortunately, many users find themselves lost in a maze of calls and offers that don’t align with their initial expectations of straightforward, low-cost coverage.

On the positive side, some individuals reported receiving support from Safex’s customer service team, particularly when they reached out for clarification or assistance with claims. However, these cases appear to be in the minority, with the majority of feedback highlighting dissatisfaction and frustration with the process.

In summary, Safex Insurance has garnered a range of reviews from customers. While it offers an easy way to access a variety of insurance quotes, the process is not as smooth or direct as advertised. Many users find themselves frustrated with the barrage of calls from insurance agents and the lack of transparency around pricing and coverage. If you’re considering Safex Insurance, it’s important to proceed with caution and be aware that you’re entering into a marketing funnel rather than dealing directly with an insurer.

Conclusion

Safex Insurance might seem tempting with its low advertised rates, but its lead generation model can lead to unwanted calls and higher costs than initially promised. If you’re looking for transparency and straightforward auto insurance, it’s worth considering trusted alternatives. Take the time to explore your options and choose an insurance provider that aligns with your needs and values. By staying informed, you can make a decision that truly works for you without the marketing hassle.

FAQs

What is Safex auto insurance?

Safex auto insurance is not an actual insurance provider. Instead, it functions as a lead generation service that connects customers with third-party insurance companies. When you sign up, your personal details are shared with insurers who may offer you policies.

Is Safex auto insurance legit?

While Safex is legitimate in the sense that it operates as a business, it is not a direct provider of insurance. The company uses advertising to attract customers with low-priced offers but ultimately passes your information to other insurance companies. The pricing and offers are not guaranteed by Safex itself.

Who is the most trusted insurance company?

The most trusted insurance companies often include well-established names like State Farm, GEICO, and Allstate. These companies are known for offering transparent pricing, customer service, and reliable claims handling.

Who is the cheapest car insurance?

The cheapest car insurance can vary greatly depending on your personal situation. However, companies like GEICO, State Farm, and Progressive often offer competitive rates. It’s always a good idea to compare quotes from several insurers to find the best deal for you.

What are Safex car insurance reviews saying?

Customer reviews for Safex are mixed. On platforms like Trustpilot and BBB, some users report disappointment with the company’s lead-generation model, which can result in multiple unsolicited calls from different insurers. While some customers find good deals, many are frustrated by the lack of transparency and the aggressive marketing tactics involved.

What should I expect when using Safex insurance?

When you use Safex, expect to provide personal information in exchange for quotes from various insurance providers. You may receive multiple marketing calls, and the initial $39–$50/month offers are not guaranteed once you enter the system. Be prepared for a more complicated process compared to dealing with direct insurers.